What is a Cat S or Cat N total loss (write off)?

What is Cat S Damage?

If a vehicle insurer decides not to repair a car or van then they must appoint an appropriately qualified person to place a salvage category on the vehicle. A Cat S (structurally) damaged vehicle is considered safe to repair but will include some degree of damage to the vehicles structure.

Once the claim is settled with the insured the vehicle will either be sold via a salvage agent or retained by the owner on a cash in lieu basis. The AQP must follow a strict code of practice including the correct use of manufacturers repair methods when determining a vehicles suitability for repair. They must either choose a repairable salvage category's N & S or non repairable A & B.

Having been sold on by the insurer there are no further rules or restrictions placed on the repairer regarding the repair method, the new owner is free to repair the vehicle at their discretion. My Car Inspections are Category N and Category S pre purchase vehicle inspection specialists, our qualified engineers use their skill and experience to assess the area/extent of the damage and quality/method of repairs carried out. Our aim is to ascertain if your potential purchase is roadworthy, structurally/mechanically sound and value for money.

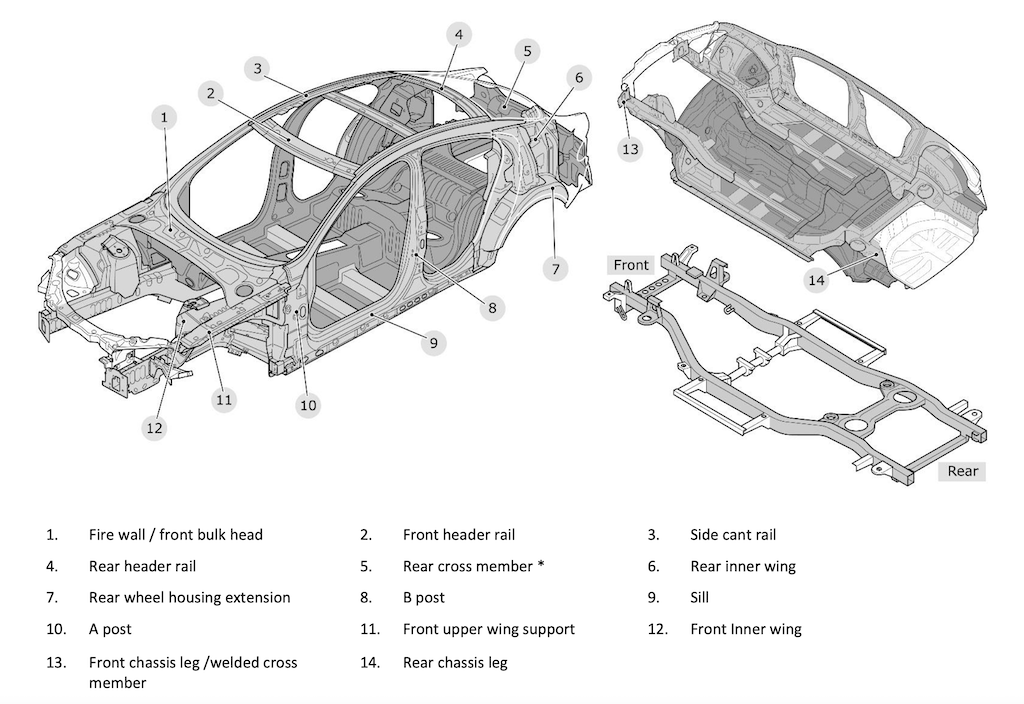

A Cat S vehicle should have some degree of structural damage, however this does not necessarily mean that the damage is signifcant. A vehicle may have been deem uneconomical to repair and the structural damage is a minor part of the overall cost. Please see the diagram indicating the structural areas.

Of course the Cat S marker may also have been applied following significant structural impact that requires essential replacement rather than repair. A qualified indepentent engineer will be able to identify the area of damage and nature of repairs carried out.

What is Cat N damage?

A Cat N vehicle has been assessed by an appropriately qualified person (AQP) and deemed safe to repair. The insurer has decided not to repair the vehicle and there should be no structural damaged sustained to the vehicle. Our qualified engineers carry out pre purchase inspections for Cat N vehicles to confirm no structural damage has been sustained and also confirm the method of repair and nature of the damaged sustained.

In addition to accident damage a Cat N vehicle may have been subject to theft, fire or flood damage. Whilst no structural damage should be present steering, suspension and vehicle safety systems like airbags may have been affected.

Like a Category S vehicle the vehicle will be sold via a salvage agent or returned to the owner on a cash in lieu basis. Repairs are often achieved with the use of recycled parts or a preference for repair rather than replace to enable a more cost effective repair.

What is Cat A and Cat B damage?

Cat A

A Cat A total loss (write off) will have sustained significant fire, flood or accident damage and have no reusable parts.

Cat B

A Cat B total loss (write off) is considered unsuitable to repair due to the nature or fire, flood or accident damage but there are parts that can be safely reused. Cat A and Cat B registered vehicles should not be sold to the general public as they are not suitable for road use and cannot be registered with the DVLA.

Are all unrepairable vehicles catergorised Cat A, Cat B, Cat N & Cat S?

No, Under the following circumstances an insurance claim may be settled by the insurer but the vehicle isn't categorised.

Classic or vehicles of special interest

Classic cars or other vehicles of specialist interest should not be categorised by an appropriately qualified person. This allows historic or rare vehicles to be resold through salvage auctions or retained by the current owner free of a Cat damaged marker, this regardless of the nature of the damage or the repair cost. Whilst it may be beneficial to retain the vehicles status, future owners will not be aware of its damaged history unless disclosed by the owner or professionally inspected.

Stolen and recovered vehicles

Vehicles are often stolen and the claim settled but then the vehicle is subsequently recovered. If in this instance there is no damage sustained or the damage is not excessive the vehicle can be sold without a Cat N marker being applied. If the vehicle is deemed uneconomical to repair then the normal Cat A, Cat B, Cat N or Cat S marker should be applied.

Why do insurers write off vehicles with little obvious damage?

Under the terms of an insurance policy the insurer has the right to choose the method of indemnity (settlement of the claim) This will include repair, replacement or cash settlement.

The insurer can therefore choose the option that suits them best, factors that may influence the decision to write a vehicle off may include new for old insurance cover within the first year of a vehicles life, the extent of the damage may be unclear so they reduce their risk by not repairing, lack of parts availability or labour (particularly as a result of Covid and worldwide parts delays) or prohibitive parts costs/manufacturers methods.

What type of damage could a Cat S or Cat N write off have sustained?

Fire

Fire damage due to component failure or arson will usually result in a Cat A marker due to damage or contamination of the vehicle structure and parts. However a Cat N marker could be applied if the damage is isolated to a small area and the vehicle can be safely repaired

Flood

Flood damage with result in Cat N, Cat B or Cat A classifications dependent upon the type of water (salt, rain or contaminated) and to what extent it has affected the vehicle. A vehicle should only be deemed suitable for resale and returned ot the road as a Cat N if the water (not salt or contaminated) has not significantly entered the passenger area to a level that causes significant electrical damage.

Theft & Vandalism

If the vehicle has suffered minor or no damage the vehicle can be resold without a Cat N or S marker being applied. If the damage is more extensive a Cat N or Cat S marker can be applied if the vehicle is considered safe to repair.

Accident

Most commonly the a vehicle will be deemed at write off due to impact damage. This could include structural or non-structural panel damage in addition to steering/suspension, electrical or vehicle safety system damage.

What are the benefits of buying a Cat S or Cat N vehicle?

Predominantly value and pre accident condition. The salvage industry has changed significantly in the last few years, in part due to restrictions placed on the insurance/repair industry due to Covid and other worldwide events. The "new normal" has seen an increase in vehicles being written off remotely via image and in many instances prematurely due to parts or labour availability. Modern vehicle design and parts costs also has become a factor, cost savings can be found using after market or recycled parts, collectively this has resulted in better quality and lighter damaged vehicles being more readily available.

Historically Cat damaged vehicles tend to be in better than average pre accident condition, this in comparison to a typical vehicle that has been part exchanged or sold through an auction due to known problems, then finding its way into trade hands. In the case of a Cat damaged vehicle it is likely that the owner had no plans to sell the vehicle at the point of loss. Mechanically fault free, one owner, lower mileage and fully serviced vehicles can often be found.

Whilst there are obvious benefits to purchasing a vehicle that will be on average 25%-30% cheaper than its uncategorised equivalent, it should be considered that there are no legislative checks or repair guidelines that need to be followed once the damaged vehicle has been purchased from an authorised salvage agent. We would recommend any Cat S or Cat N vehicle is inspected prior to purchase by a qualified vehicle damage assessor to confirm the extent of the damage sustained, method of repair used and the safety and longevity of the work carried out.

Incorrect categorisation of salvage is not uncommon due to more desktop than physical assessments now taking place. It is important to know if a Cat N vehicle actually has structural damage or a Cat S vehicle has sustained lighter damage than anticipated. All of our engineers that carry out Cat damaged vehicle inspections hold current AQP (appropriately qualified person) qualifications and have full understanding of the categorisation process.